A Comprehensive Guide to Setting Stop-Loss to Minimize Risk in Cryptocurrency Trading

When it comes to trading cryptocurrencies, volatility is inevitable. The prices of coins can change rapidly, which can be profitable, but also risky. One of the most effective tools to protect your capital and manage risk is the stop-loss order. In this article, we'll guide you on how to use stop-loss orders to reduce risk and safeguard your investments.

What is Stop-Loss?

A stop-loss is an automatic order placed with a broker to buy or sell once the price of a cryptocurrency reaches a certain level. This is done to prevent further losses in case the market moves against your position.

For example, if you’ve bought Bitcoin at $30,000, setting a stop-loss ensures that you won’t lose more than a predefined amount if the price falls.

Why is Stop-Loss Important?

Without a stop-loss, you risk losing your entire investment in a volatile market. The cryptocurrency market is known for its sharp fluctuations, where prices can skyrocket, but they can also plunge drastically within minutes.

By setting a stop-loss, you can protect yourself from major losses, reduce emotional decision-making, and ensure your trades are more disciplined.

How to Set Stop-Loss Based on the Entry Price?

The calculation for stop-loss is simple. It’s generally based on a percentage of the entry price. Let’s break it down for both BUY (LONG) and SELL (SHORT) orders.

For BUY Orders (Long Position):

When you enter a long position, you're betting that the price of the cryptocurrency will rise. A stop-loss in this case helps you minimize losses if the market goes against your prediction.

Formula:

Stop-loss = Entry Price - (Entry Price × Stop-Loss Percentage)

Example:

Let’s say you bought Ethereum (ETH) at $2,000 and set a 2% stop-loss.

-

Stop-loss = 2,000 - (2,000 × 0.02) = $1,960

In this case, if the price of Ethereum falls to $1,960, your position will automatically close, limiting your loss to 2%.

For SELL Orders (Short Position):

When you enter a short position, you're betting that the price will decrease. A stop-loss helps you minimize potential losses if the market moves in the opposite direction.

Formula:

Stop-loss = Entry Price + (Entry Price × Stop-Loss Percentage)

Example:

Let’s say you sold Bitcoin (BTC) at $30,000 and set a 3% stop-loss.

-

Stop-loss = 30,000 + (30,000 × 0.03) = $30,900

In this case, if the price of Bitcoin rises to $30,900, your position will automatically close, preventing further losses.

Practical Example of Setting Stop-Loss

To give you a real-world example, let’s say you are trading Litecoin (LTC) at an entry price of $200, and you set a stop-loss of 5%. Using the formula above:

-

Stop-loss = 200 - (200 × 0.05) = $190

This means if Litecoin’s price drops to $190, your trade will automatically close, limiting your loss to 5% of the initial trade.

The Role of Stop-Loss in Risk Management

Stop-loss orders play a crucial role in risk management. It’s a key tool to ensure that no single trade can wipe out your entire capital. In fast-moving markets, having a stop-loss order in place can be the difference between minimizing a loss or losing a significant portion of your capital.

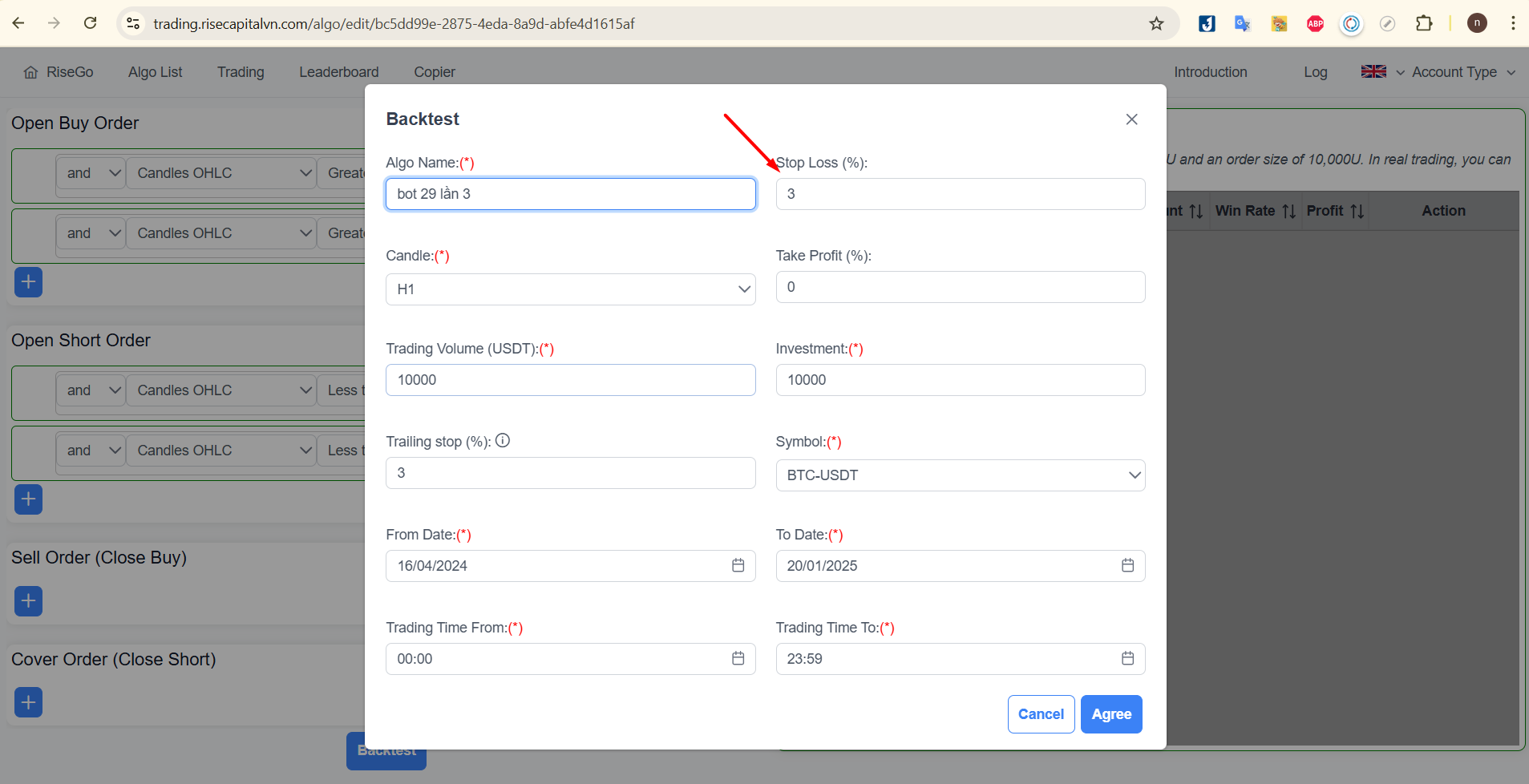

Testing Stop-Loss Strategies

Before applying your stop-loss strategy in live trading, it's essential to test it. You can backtest your strategy and fine-tune it using demo accounts. The RiseGo platform offers a free demo trading environment, allowing you to practice and optimize your stop-loss strategy without risking real money.

With RiseGo, you can:

-

Test your stop-loss settings with various cryptocurrencies.

-

Adjust your strategy to fit your risk tolerance.

-

Learn and practice risk management without the pressure of real trading.

Conclusion

Setting a stop-loss order is one of the easiest ways to reduce risk and protect your investments in the cryptocurrency market. By calculating stop-loss based on a percentage of the entry price, you can minimize your losses and maintain control over your trades.

If you're new to stop-loss orders or want to refine your strategy, consider using RiseGo's free demo trading platform. It provides you with the perfect environment to learn and practice without financial risk.

Take the First Step in Protecting Your Investments with RiseGo’s Demo Trading Platform!

Try it now for free and start trading smarter today!