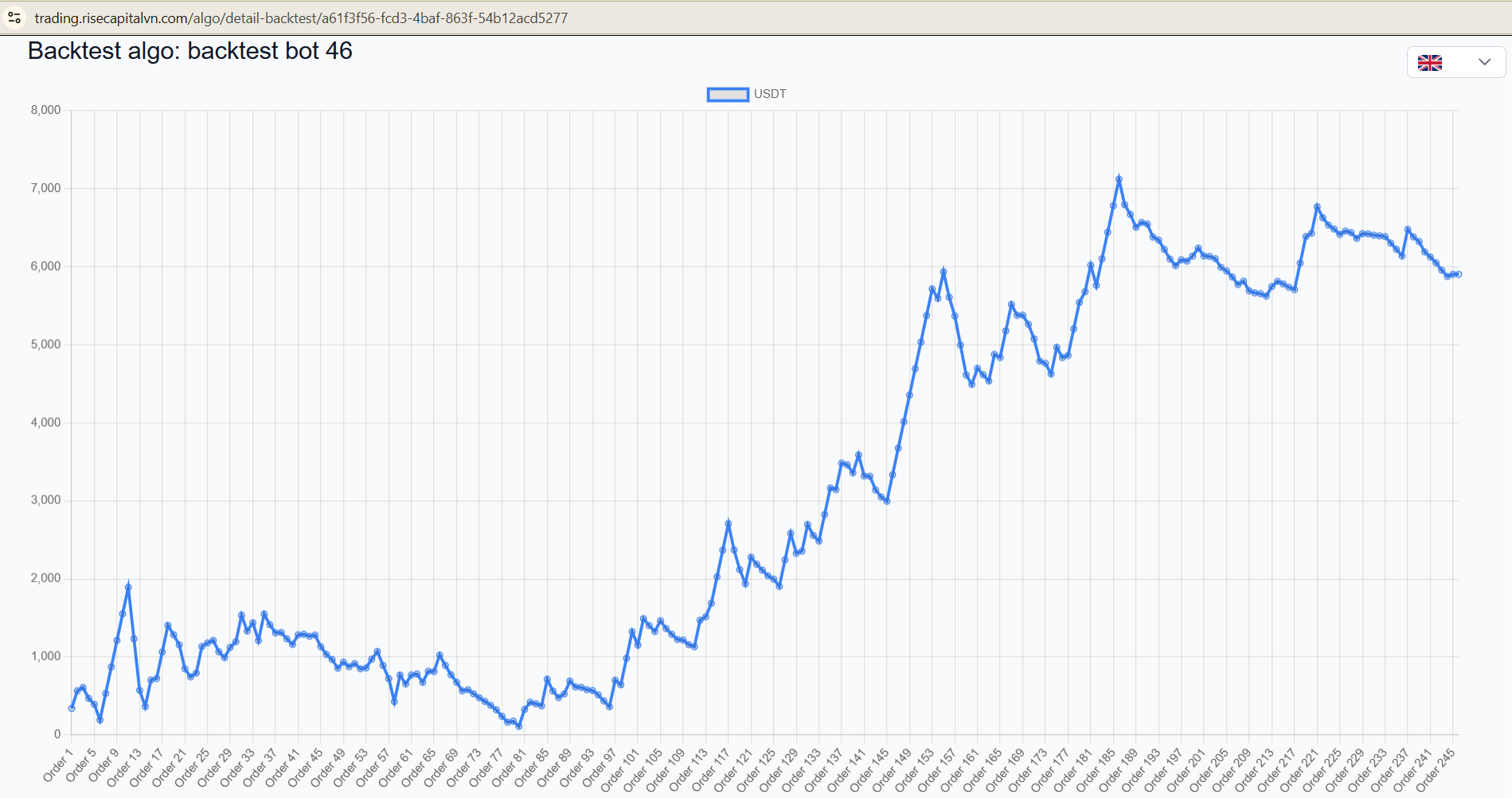

Backtesting: How to Evaluate Your Trading Strategy Without Coding Using Risego

Understanding Backtesting

Backtesting is a method used by traders to evaluate the effectiveness of a trading strategy by applying it to historical market data. This process allows traders to understand how their strategy would have performed in the past before risking real capital in live markets.

By analyzing past performance, traders can identify potential strengths and weaknesses, optimize parameters, and refine their strategies for better results.

Why is Backtesting Important?

Backtesting is a crucial step in developing a successful trading strategy. Some key benefits include:

-

Risk Reduction: Testing a strategy on past data helps traders avoid unnecessary losses in live markets.

-

Performance Evaluation: It provides insights into key metrics such as profitability, drawdowns, and win rates.

-

Strategy Optimization: By adjusting parameters, traders can enhance the effectiveness of their strategy.

-

Confidence Building: A well-tested strategy gives traders more confidence in live trading scenarios.

The Challenge of Traditional Backtesting

Traditionally, backtesting requires coding knowledge and access to historical market data. Traders often use programming languages like Python or platforms such as MetaTrader to run simulations. However, this approach has several limitations:

-

Requires coding skills: Many traders lack the programming expertise needed to implement backtests.

-

Time-consuming: Manually coding and optimizing strategies can take significant time and effort.

-

Limited data access: Not all traders have access to reliable and extensive historical market data.

Backtesting with RiseGo: No Coding Required

RiseGo simplifies the backtesting process by providing an intuitive, user-friendly platform that eliminates the need for coding. With RiseGo, traders can:

-

Test strategies with 5 years of historical data across multiple cryptocurrencies like BTC, ETH, and altcoins.

-

Use over 100+ technical indicators to create and optimize strategies.

-

Run automated backtests instantly without writing any code.

-

Simulate trading with demo accounts before applying strategies to live markets.

-

Access pre-built profitable bots and copy trading features for easier strategy implementation.

How to Backtest a Trading Strategy on RiseGo

-

Sign up on RiseGo: Register and access the trading bot platform.

-

Create or select a strategy: Use built-in indicators or customize your own.

-

Set parameters and backtest: Choose historical data and let RiseGo simulate the strategy's performance.

-

Analyze results: Review key metrics such as profit percentage, drawdown, and risk-reward ratio.

-

Optimize and implement: Make adjustments based on backtest results and apply the strategy to a live or demo account.

No Need for Backtesting? Copy Trade Instead!

For those who prefer a hands-off approach, RiseGo also offers a Copy Trading feature. Instead of backtesting and developing your own strategies, you can:

-

Follow successful traders with proven track records.

-

Automatically copy trades from high-performing bots.

-

Minimize risks by leveraging expert strategies.

Conclusion

Backtesting is an essential step in validating trading strategies, and with RiseGo, traders can easily test, optimize, and execute strategies without coding. Whether you prefer backtesting or copy trading, RiseGo provides a powerful solution for maximizing trading performance while minimizing risk.

Start optimizing your trading strategy today with RiseGo and take your trading to the next level!